“Either you are part of the solution, or you are part of the problem.” Eldridge Cleaver.

For investors, climate change poses both financial risk and opportunity. The USA and the global economy are beginning the transition to a lower-carbon economy, which is estimated to require about $1 trillion USD of investments each year for the foreseeable future.

New investment opportunities in energy efficiency and renewable energy are opening. At the same time climate-related financial risk for industry is increasing. Companies, communities, and agriculture are affected by the physical impacts of climate change, while climate policy and new technologies are shifting the risk-return profile for American business.

A 2015 study by the Economist Intelligence Unit titled, “The cost of inaction: Recognizing the value at risk from climate change” estimates that the discounted net present value of expected losses to global manageable physical assets is $4.2 trillion USD, which is roughly equal to total shareholder value of all the world’s listed oil and gas companies.

We should ask; what value are we protecting by continued inaction? Consider the financial impact after oil, coal, and natural gas companies trash $4.2 trillion of our assets. People will have no legal recourse when fossil fuel producing companies loose value, as we rid ourselves of the cause of environmental damage.

The Economist study highlights that “much of the impact on future assets will come through weaker growth and lower asset returns across the board.” Investors may not be able to avoid climate-related risks by moving out of certain asset classes as a wide range of asset types could be affected. The first principle of investing is to preserve capital. The asset management industry and investors should prepare for expected losses due to climate change, in the context of declining economic growth and lower asset returns.

Global warming is both immediate and long-term, with substantial risk of extreme events which have become more frequent, including devastating tropical storms fueled by increased atmospheric energy. Just last summer in the Pacific NW, forest fire storms wiped out entire towns while forest fire ash fell like snow at my house. I have worked for over a decade on renewable energy, economic sustainability, and climate change. But now, its personal.

Lending, insurance underwriting, and investment decisions increasingly tie to climate-related risk from drought, floods, powerful storms, and loss of agricultural productivity. Forward looking leadership on climate adaptation is the minimum needed to allocate capital spending toward a smooth transition to a lower-carbon economy.

For many people, environmental sustainability equals survive-ability. The Brookings Institute reports that,

“Regions already struggling economically will be hit the hardest by climate change. The worst-off USA counties in terms of economic vitality, labor market, income, and share of national GDP will experience the most damage.

Counties that will be hit hardest by climate change tend to be in the South and Southwest regions of the United States, with over half of those located in Florida, Louisiana, North Carolina, South Carolina, and Texas. Low-income Americans with few marketable skills are often unable to migrate in response to climate change, which exposes them to hardship. While high technology solutions to climate change are often developed in prosperous counties in the Northeast, upper Midwest, and Pacific regions, where communities are less exposed to climate damage.”

Brookings Education

Environmentally progressive companies create new business opportunities through innovation while attracting and retaining the best talent. The Sustainable Leaders Forum points out that companies engaged in adaptation and mitigation of climate change prosper financially in the immediate term because financial savings accrue through streamlining & efficiencies.

According to the study “The Future of Business Citizenship” attracting the brightest talent depends on a clear commitment to environmental stewardship. Accelerating business growth is achieved through innovation by front-line employees who have day-to-day knowledge of customers, facilities, logistics, production operations, and procurement in a program that harnesses employee knowledge and reports results on a regular basis. According to the study 4 out of 5 Millennials say they want to be an active part of the change they want to see in the world and by 2025, 75% of the global workforce will be millennials. One respondent said, “Businesses have the resources, collective intelligence, and technology to make a difference.” Companies that enlist employees to innovation programs generate better ideas and implement them more effectively.

The approach to climate change can go beyond operational effectiveness and become strategic. Some firms will find opportunities to enhance or extend their competitive position by creating products that exploit climate-induced demand, while innovating to produce a genuine competitive advantage.

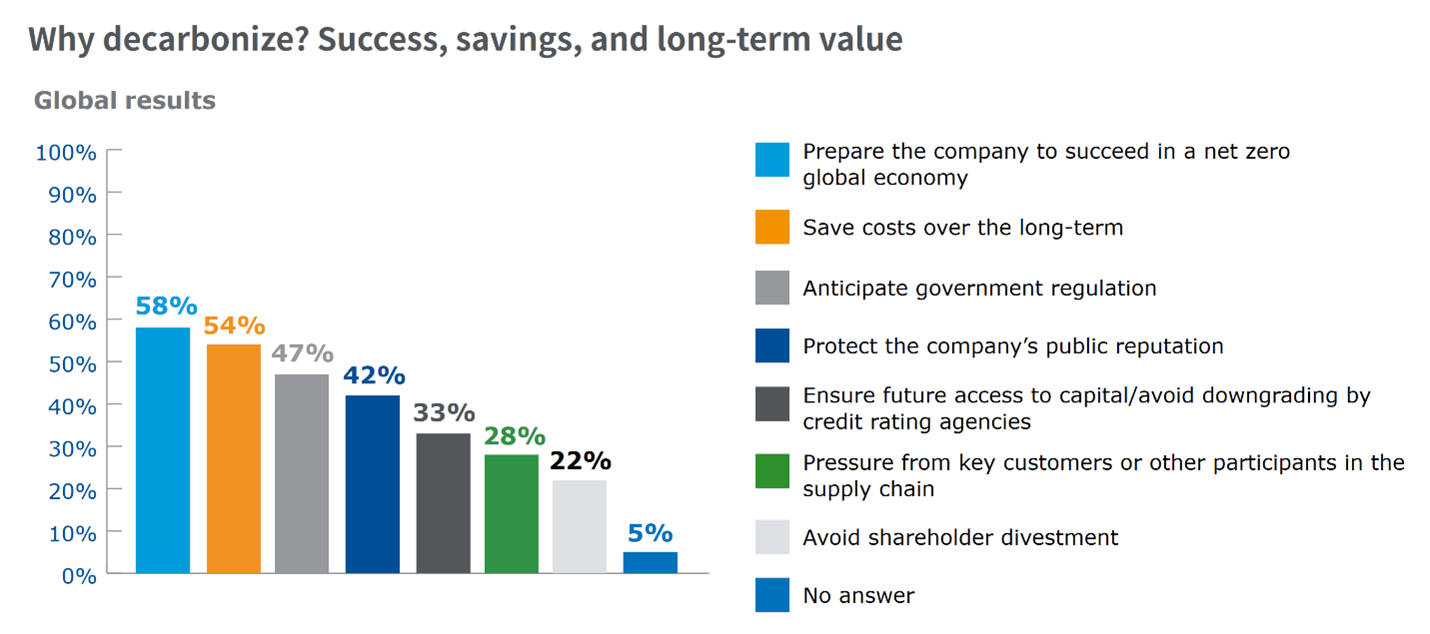

The 2008 McKinsey & Company report, How climate change could affect corporate valuations section Decarbonizing is Good for Business reports that:

Companies are now able to:

• Procure renewable heat and power

• Procure energy efficiency solutions throughout their business processes

• Reconsider their approach to waste

• Raise green finance

• Invest themselves in energy transition assets

• Form greener ventures or partnerships

The World Business Council for Sustainable Development issued guidelines on how to create an integrated energy strategy. Rather than focusing only on energy-related financial and environmental objectives and being inward looking, the World Business Council shows how a company can work cross-functionally internally and with upstream and downstream stakeholders externally so that it transitions from being a passive energy user to a proactive player.

McKinsey & Company

Opportunities exist in selling tools to facilitate the transition to reduced carbon emissions. The International Energy Agency November 2020 report

Tracking Clean Energy Innovation, A framework for using indicators to inform policy reports that energy innovation policy includes identifying gaps and opportunities.

Clean energy transitions

The October 2007 issue of the Harvard Business Review, titled Climate Business | Business Climate states that:

“For some companies the approach to climate change can go beyond operational effectiveness and become strategic. Some firms, in the process of addressing climate change, will find opportunities to enhance or extend their competitive positioning by creating products … that exploit climate-induced demand, by leading the restructuring of their industries to address climate issues more effectively, or by innovating in activities affected by climate change to produce a genuine competitive advantage.”

Sources:

The cost of inaction: Recognizing the value at risk from climate change

The Future of Business Citizenship

October 2007 issue of the Harvard Business Review,

Climate Business | Business Climate

Accounting giant KPMG report

Climate change and corporate value: What companies really think